The imminent conclusion of the legally binding Global Plastics Treaty in 2024 and the joint release of the Sunnylands Statement by China and the United States send a strong signal to the world for global collaboration in actively addressing plastic pollution. This brings unprecedented development opportunities for the plastics recycling industry.

According to the latest research report from InsightAce Analytics, the global plastics recycling market size is forecast to grow at a 7.71% CAGR from 2024 and reach US$77.89 billion by 2031. Faced with this immense opportunity, end-user brands, plastic product manufacturing companies, recycled plastics and recycling companies are seizing the chance for business growth, while also fulfilling their social responsibilities.

Mechanical, chemical, and biological recycling technologies

Compared to mechanical recycling, which has already established an industrial scale, chemical recycling is still an emerging technology. However, in recent years, we have seen European chemical companies continuously investing in chemical recycling, and more Chinese companies are actively participating in the chemical recycling boom. In addition, new recycling technologies, such as biological recycling, have also begun to operate on a larger scale, further enriching the means of plastic waste processing.

Thanks to its superior plastic waste processing and crude oil substitution capabilities, chemical recycling has been driven by significant investment from leading international petrochemical and processing companies. For example, Saudi Basic Industries Corporation (SABIC) has partnered with Plastic Energy, the UK-based chemical recycling company, to advance the processing of mixed post-consumer plastics; ExxonMobil and Sealed Air (SEE) use chemical recycling technology to convert plastic waste into new food-grade packaging; Coperion is supplying a complete system of the chemical recycling of polymethyl methacrylate (PMMA) to a plastic product manufacturer in Dubai.

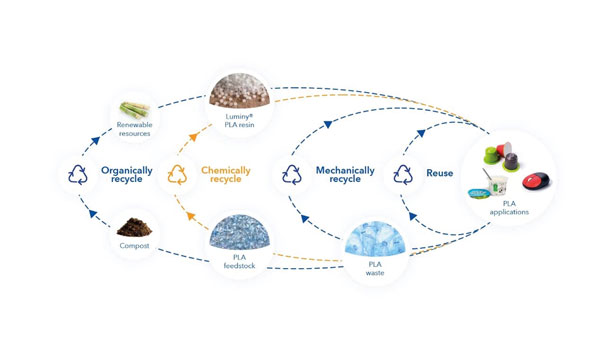

In addition to the recycling of fossil-based plastics, there have been new developments in the recycling of bio-based plastics such as polylactic acid (PLA). TotalEnergies Corbion utilizes depolymerization technology to produce Luminy® rPLA, which has up to 30% recycled content, offering performance comparable to virgin PLA.

In addition to the recycling of fossil-based plastics, there have been new developments in the recycling of bio-based plastics such as polylactic acid (PLA). TotalEnergies Corbion utilizes depolymerization technology to produce Luminy® rPLA, which has up to 30% recycled content, offering performance comparable to virgin PLA.

Notably, China has been developing rapidly in the field of chemical recycling in recent years. For example, Tianjin Bohai Chemical, China Tianying and Jiutai New Material have successively collaborated with international companies like Honeywell to launch chemical recycling projects. Such Sino-foreign collaboration further advances the development of chemical recycling in China. In 2023, Zhejiang Jiaren New Materials made the global debut of its recycled dimethyl terephthalate (DMT), filling the gap in China’s recycled DMT sector. Many other Chinese companies, including Sinopec, CR Chemical Materials, Wanhua Chemical and Beijing Aerospace Petrochemical are also actively implementing chemical recycling projects.

In addition to mechanical and chemical recycling, biological recycling is also emerging as a new plastics recycling method. In 2023, the biological recycling technology for polyethylene terephthalate (PET) was selected by the International Union of Pure and Applied Chemistry (IUPAC) as one of the “Top Ten Emerging Technologies of the Year”. The French company Carbios has been granted the license to build and operate the world’s first PET biological recycling plant. International giants such as Coca Cola and Procter & Gamble (P&G) have also successfully applied PET biological recycling technology in production and are promoting the products globally.

Packaging: Towards high-value and intelligent recycling

As one of the main sources of plastic waste, post-consumer plastic packaging waste has always been the focus of global plastics recycling and circular economy. As the pioneer in the circular economy for plastics, Europe has made enormous efforts in this area. Germany, France and the UK have enacted regulations for plastic packaging to accelerate the implementation of packaging waste management. In 2023, the European Union further proposed the Packaging and Packaging Waste Regulation (PPWR), which sets out new rules for the proportion of recycled plastic in packaging.

Meanwhile, international brands such as Coca-Cola, PepsiCo, P&G, and Unilever have been actively fulfilling their social responsibilities by setting targets for the use of recycled plastic in packaging at different time intervals (by 2025/2030), thus encouraging the participation from more stakeholders in plastic packaging circularity worldwide.

In particular, with the development of bottle-to-bottle recycling solutions and the expansion of food-contact recycled plastics, the PET bottle recycling industry is moving towards efficient and intelligent processing. For example, Starlinger, an Austrian supplier of plastics recycling machinery, has developed the recoSTAR PET system for bottle-to-bottle recycling, which saves 25% of energy consumption, increases production by 15%, and helps reduce production costs by approximately 21%.

Flexible packaging has long been identified as a challenge in plastics recycling. In recent years, leading global food brands, packaging suppliers, and recycling technology providers have joined forces to promote the circular use of flexible packaging. Mondelēz International and Amcor have built Australia’s first chemical recycling facilities, processing 20,000 tons of plastic waste annually, with Mondelēz International reapplying recycled materials to product packaging. Nestlé has invested £7 million in Impact Recycling, a UK recycling technology supplier, to establish a new plant that converts hard-to-recycle flexible packaging into plastic pellets for reuse in flexible packaging production.

Unleash the possibilities in recycling industry at CHINAPLAS 2024

Unleash the possibilities in recycling industry at CHINAPLAS 2024

CHINAPLAS 2024 is set to make a strong comeback to Shanghai on April 23 – 26, 2024, and will collaborate with leading material suppliers and recycling equipment manufacturers to support the industry’s sustainable development goals and create new opportunities in recycling and reuse applications. The show will occupy all 15 exhibition halls of the National Exhibition and Convention Center (NECC) in Hongqiao, Shanghai, PR China, with a total exhibition area of over 380,000 sqm. It is ready to receive more than 4,000 exhibitors from around the world.

The online pre-registration of CHINAPLAS 2024 has started. All visitors are required to pre-register and reserve the entry dates in advance for admission of the show. Pre-register now for an admission ticket at RMB 50 or USD 7.5. Pre-registered visitors shall receive their Visitor eBadges (for local visitors) or eConfirmation Letters (for overseas visitors). Admission tickets are available on a first-come, first-served basis.

Official Website: www.ChinaplasOnline.com

Source: Adsale Plastics Network (www.AdsaleCPRJ.com)